About ISOs

Gain clarity and implement an action plan based on your Incentive Stock Options (ISOs)

What is an Inventive Stock Option (ISO)?

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Incentive stock options (ISOs) differ from nonqualified stock options in terms of their tax treatment. ISOs are eligible for specific tax advantages when they meet specific criteria outlined in Section 422 of the Internal Revenue Code (IRC), often referred to as "tax-qualified stock options."

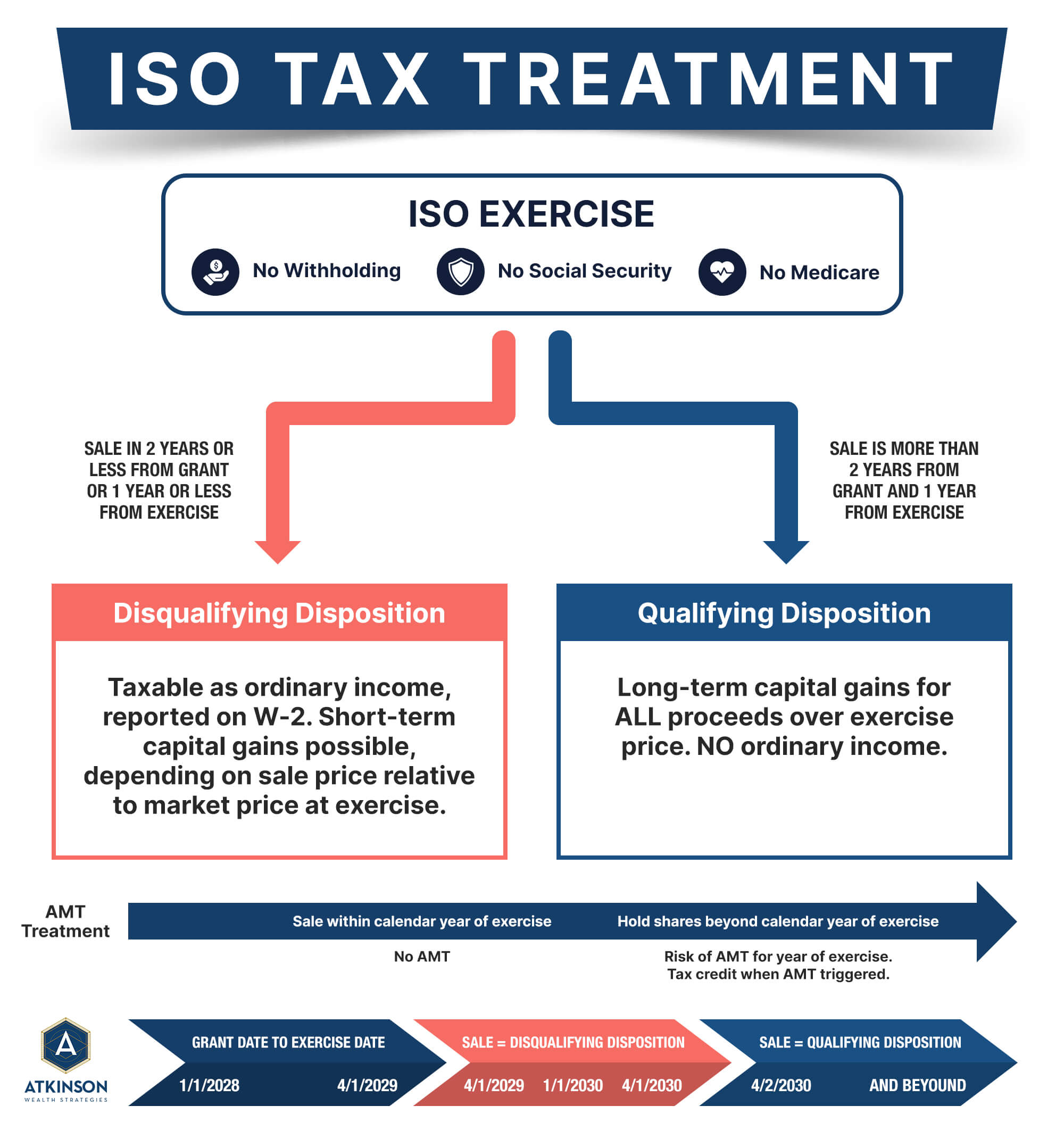

When you exercise ISOs and hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you become eligible for a more favorable long-term capital gains tax rate on any appreciation above the exercise price, as opposed to the standard ordinary income tax rate. Additionally, unlike nonqualified stock options (NQSOs), ISOs do not trigger Social Security, Medicare, or withholding taxes upon

exercise.

ISO Holding Periods

Make sure to keep track of your Dates

The tax treatment of ISOs hinges primarily on the duration for which you retain the shares following their exercise. Initially, exercising an ISO may potentially trigger the alternative minimum tax (AMT) if you continue to hold the stock through the entire calendar year of exercise. However, if you hold the shares for a sufficient period, leading to a qualifying disposition, such as a sale or gift, any appreciation beyond the exercise price is categorized as capital gains.

On the other hand, if you don't hold the shares for an adequate duration, resulting in a disqualifying disposition, the tax implications encompass ordinary compensation income, and any capital gains or losses may fluctuate based on the interplay between your exercise price, the market price at exercise, and the eventual sale price. See image Below:

RSU Vesting Options

Graded

A vesting schedule wherein a specific portion becomes vested and attainable on an annual, monthly, or quarterly basis.

Example:

Year 1: 25%

Year 2: 25%

Year 3: 25%

Year 4: 25%

Cliff

A vesting schedule entails the complete vesting of a stock option or restricted stock/RSU grant in a single instance, following the fulfillment of vesting prerequisites. These prerequisites often encompass the duration of employment, achievement of performance objectives, or a blend of both factors.

Example:

Year 1: 0%

Year 2: 0%

Year 3: 100%

Alternative Minimum Tax (AMT)

Planning for the AMT implications of an ISO exercise/hold is a necessary part of your overall strategy. This is done with collaboration from your Financial Advisor and CPA

The alternative minimum tax (AMT) system can be complex. It incorporates various positive and negative adjustments to your standard taxable income, along with tax elements known as AMT preferences. This computation yields what is termed your "alternative minimum taxable income" (AMTI), a figure often higher than your taxable income under the regular tax framework.

When it comes to ISOs, the spread resulting from their exercise contributes to an increase in AMT income for the year in which the exercise occurs, particularly if you retain ownership of the acquired shares throughout the calendar year of exercise. This exercise spread is categorized as a positive adjustment within the calculation of your AMT income.

Efficiently navigate your ISOs and establish a strategic plan

Know the important dates

Know the Tax Impact on your financial situation

Understand strategies for Reducing AMT Exposure

Review Concentration Risk in Overall Asset Management Strategy

Learn More About How We

Incorporate Your ISOs Into a

Comprehensive Financial Plan

We know the ins and outs of ISOs. Gain the clarity you deserve by letting us help you navigate your situation and establish a plan that aligns with the rest of your finances.

Frequently Asked

Questions

A cashless exercise of incentive stock options (ISOs) entails the process of selling a portion of the shares obtained upon exercise to cover both the exercise expenses and any associated tax liabilities. One notable advantage of a cashless exercise is its capacity to eliminate the need for direct personal expenditures to cover the exercise costs and tax obligations.

This is quite common for the clients we work with. What started off as small amount has grown to a significant amount through stock price appreciation and additional vests over the years. They find themselves sitting on 6 – 7 figures in 1 or 2 stocks. Tax efficiencies are critical while we work through the custom financial planning and asset management process. While also being focused on the concentration risk.

Understanding the taxes in your overall financial plan when dealing with ISO is extremely important. We work with you CPA in developing the best strategy specifically for you.

Learn more about the value and uses of your ISOs

I should have been doing this 10 years ago!

Effective financial planning, investing, and tax management demand a distinct set of expertise and abilities that may not be inherent to individuals. Numerous highly intelligent individuals opt against being self-directed investors. It is prudent to seek expert guidance for matters concerning financial planning related to stock compensation and the associated tax implications. When in the process of selecting a financial advisor, there are two key inquiries to consider:

- How frequently does the advisor engage with equity compensation, particularly in relation to restricted stock, ISOs, and performance shares?

- Is the advisor able to furnish referrals from clients who have dealt with stock compensation?

Schedule your complimentary

wealth review

Free up your time with a creative, personalized wealth

management plan you can feel confident about.